Axletree provides a value-added suite of solutions spanning the entire financial ecosystem. We bring solutions that address specific challenges in specific markets – one such challenge is in the trade industry and the process flows that facilitate seamless exchange of trade documents. In partnership with TallyX, Axletree addresses this challenge through the implementation of Smart Contracts. Read more to learn how this solution can be of value to you.

Smart Contracts and Tokenization to Revolutionize Open Account Trade

Written by Aditya Menon, CEO of Tallyx, Inc.

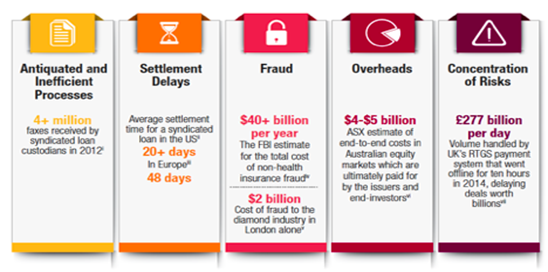

The idea of smart contracts has been around for a while, ever since Nick Szabo coined the term in 1997. Fundamentally, a smart contract is a code that is executed when certain conditions are met. So, what does this have to do with the problems within the financial industry today? A recent study by Cap Gemini shows that wherever you have central counterparties, there is the possibility of inefficiency, long and complicated settlements, a central point of attack for fraudsters, unnecessary overhead, and a concentration of risk.

How Smart Contracts Can Automate Trade Processes

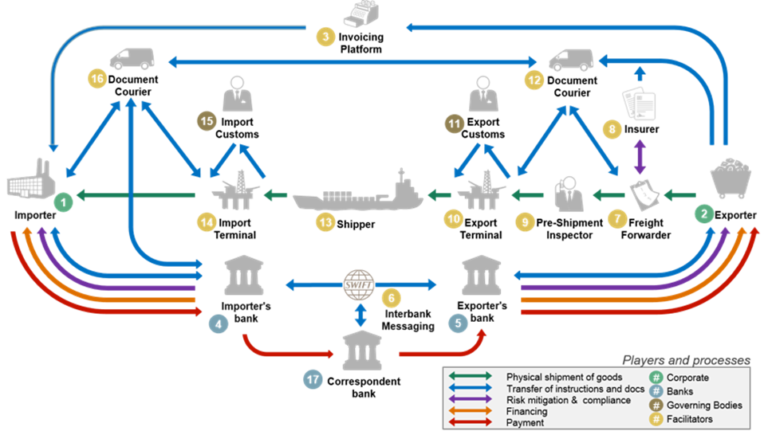

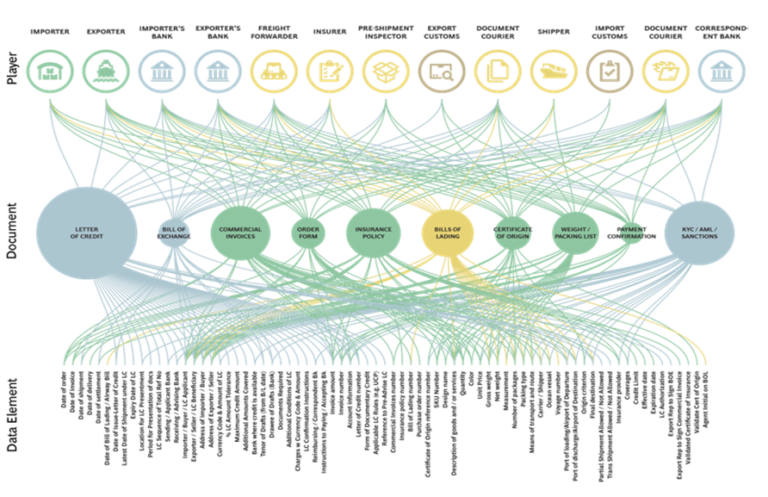

Trade finance is an area I have helped to automate through three successive companies, both as an entrepreneur and as a banker. In 1988, when I worked for Computer Catalysts in New York, we designed a very simple rule-based system for corporates to capture the complex rules associated with a letter of credit using a template and meta-tag language. This allowed corporate treasuries to design their own letter-of-credit input templates for trade. Our rule engine scanned each template for compliance with the SWIFT MT 700 standard for letters of credit. Jumping forward 30 years to 2018, little has changed, because even though the message is electronic, the accompanying documentation is still paper-based. Below, you’ll find an example of how complex that paperwork really is for a standard letter-of-credit transaction.

Firstly, there are a number of stakeholders in a trade transaction, and most of the documents flow between parties in paper form.

At present, these are all progressing at a snail’s pace, which is why we are focusing our initial attention on a simpler subset of the industry: open account trade and supply-chain finance. The purchase order is at the center. This is a much simpler document than the LC, which we are working to codify as a set of smart contracts guaranteeing payment terms, due date, interest-rate penalties, etc.

We look at the industry through two lenses. The first is smart contracts for goods, and the second is smart contracts for services. As we step back and examine the landscape, we see the opportunity for building smart contracts around smart assets. This is our vision for the future, as seldom does a platform offer a win-win-win for all parties; anchor enterprises improve their working capital through extended payment terms and enhance their treasury yield; this leads to better control and visibility over their supply chain to improve resilience and implement sustainability. Sellers get access to inclusive finance at reasonable rates. Funders get access to a much larger pool of financeable assets through better packaging of trade assets and their associated risk via our blockchain tokenization and AI technology.

The Tallyx Smart-Contract and Token Framework: the Solution for Supply-Chain Finance

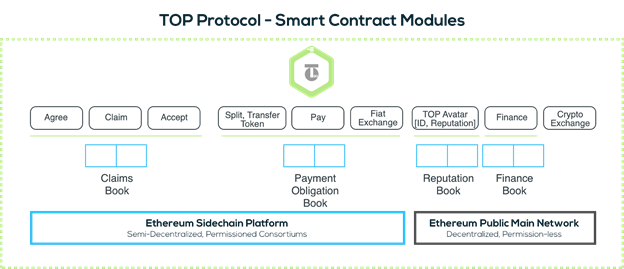

A key goal of our smart contracts is to provide outcome-driven clauses with auto-validation and auto-triggered payments when underlying conditions are met. In the example below, our smart contract would trigger instructions upon maturity to debit the buyer’s clearing account and credit the supplier. In our ecosystem, the “platform” below is a set of smart contracts deployed on the blockchain and “owned” by participants and stakeholders in our network, not by any central entity. Not even us.

Most of the work surrounding the management of business obligations is done manually today, but with the introduction of blockchain, smart contracts, and more specifically Tokenization, it is a natural progression to encapsulate this manual work into a token based protocol powered by artificial intelligence and advanced analytics.

With tokens we can replace the spaghetti of messaging and reconciliation shown above with a single clean version of the truth that can be accessed in real time by all relevant stake holders in the Trade Finance supply chain.

Our smart-contract framework will cover the negotiation of buyer and seller agreements, record those agreements on a crypto-ledger, and validate claims against the agreements, providing for negotiation and acceptance/rejection of claims. We will start with the purchase order and extend this out to cover invoices — and, eventually, the letter of credit itself.

Further, our smart-contract framework will facilitate multi-party agreements. Even in the supply chain, integrated project delivery (IPD) formats are becoming popular for large orders in order to share risk and assure SLAs. This needs to be woven into the blockchain ledger and the contracting world for enterprises, with sufficient security, audit, and corporate consensus. Therein lies the challenge, as well as the opportunity — which the Tallyx team is qualified to fulfill.

From a technological viewpoint, the promise of industry 4.0 and IoT requires mature smart-contract implementation to ensure that “things” can interact, pay, and settle automatically based upon a set of established rules.

There exist a number of interesting industry initiatives to further develop the necessary framework and taxonomy for smart contracts. This includes Digital Asset, which has proposed a smart-contract modeling language to Credits, Eris, and many others.

Tallyx is a member of Accord, a cross-industry initiative to build smart-contract taxonomies across industries, and has partnered with Axletree, the leader in financial messaging, to deliver this service to the global market. It feels great to be a part of this exciting new journey.

At the end of the day – there have to be direct benefits for all stakeholders, including Anchor Corporates, Suppliers and Funders in the supply chain. Explore the future of supply chain finance with TallyX, and be part of the global adoption of tokenization.