With the evolution of real-time and instant payments, we have expanded our marketplace to support real-time payment solutions. This exciting initiative brings services such as “Flux for RTP” and Faster Payments through the Federal Reserve FedNow initiative program to Axletree’s client base, further aligning with our strategy of providing leading connectivity and integration solutions. To support this initiative, we have established a strategic alliance with Evolvus Technologies to provide real-time payments capabilities via their Flux platform. The following article discusses the benefits of real-time payments and the value to be realized in a constantly evolving payments landscape.

How Real-Time Payments Can Modernize the Payments Ecosystem

Written by Balaji Jagannathan, CEO of Evolvus Technologies

Real-Time Payments, which is the transfer of funds from one bank account to another bank account almost immediately, is commonplace in many countries across the globe. The USA has also come quite a distance with such a payments initiative. The 2017 launch of Real-Time Payments (RTP) by The Clearing House (TCH) in the United States is billed as the new payment system initiative in the country in more than four decades. Since then, most top US banks have already implemented the RTP infrastructure in their payments ecosystem.

Corporates have developed innovative solutions involving real-time payments to accelerate their business and improve customer experience. As the RTP infrastructure grows more ubiquitous, more and more retail and commercial use cases are being built around it. For example, Uber has introduced instant credits toward trip fees for drivers upon completion of their trips.

Retail customers can use their mobile banking experience to transfer funds instantly to the recipient. They can also use this facility to execute small value payments for across the counter transactions which they would otherwise pay by cash.

Let us explore the impact of the real-time payments system in the United States and the benefits and opportunities offered by RTP for banks.

Market Factors Driving Change in the Payments Ecosystem

- 83% Respondents indicate the need to improve the efficiency of the payment system

- 51% Market respondents demand for better payment system/settlement services

- 47% End user respondents demand for better payment system/settlement services

* Source: Payment Systems Worldwide, Outcomes of the Global Payments System Survey 2010, World Bank

RTP addresses the needs and expectations of the modern world

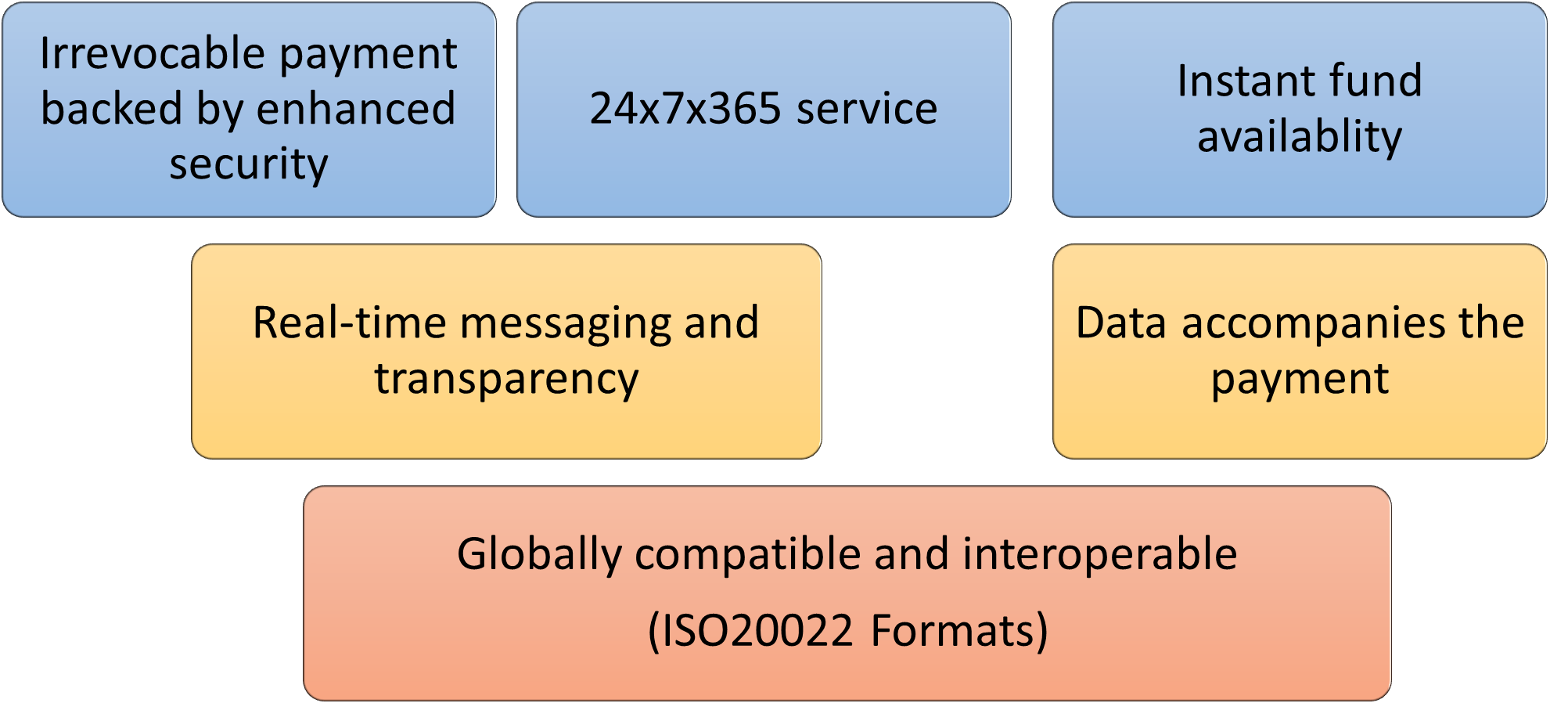

Real-time Payments offer agility of payment, extensive data exchange, real-time notification and messaging and 24x7x365 availability. This can help improve cash flow, operational efficiencies, data transparency, accuracy and customer engagement.

Benefits of Real-time Payments

- For consumers

- 24x7x365 access to funds

- Zero friction payments

- Secure instant transactions

- For corporates

- Enhanced efficiency in e-invoicing and billing

- Improved liquidity management

- Optimized working capital management

- For government

- Anytime, traceable, emergency benefit payments

- Increased tax revenue from GDP growth

- Global harmonization

- For economy

- Increased velocity of money

- GDP growth as a result of higher payment volumes

- Market efficiency

- For society

- Reduction of crime and security issues related to cash handling

- Reduced risks of fraud and AML

- Spread of a 24x7x365 service financial culture

RTP lays the foundation for safer, smarter and faster digital payments

With a strong emphasis on data and messaging functionality, the RTP system in the USA is considered amongst the most advanced in the world.

The true value of RTP lies in instant availability of funds and payer authorization of every transaction. When each transaction needs specific authorization by the payer, the power is returned to the hands of the payer. The fact that the payment cannot be revoked makes the payer responsible as well. Hence both power and responsibility are firmly in the hands of the payer in RTP. Instant availability of funds to the receiver ensures that the receiver does not need to face the agony of waiting for T+2 days to receive funds. In commercial transactions, merchants can receive funds right when the value is delivered to the customer.

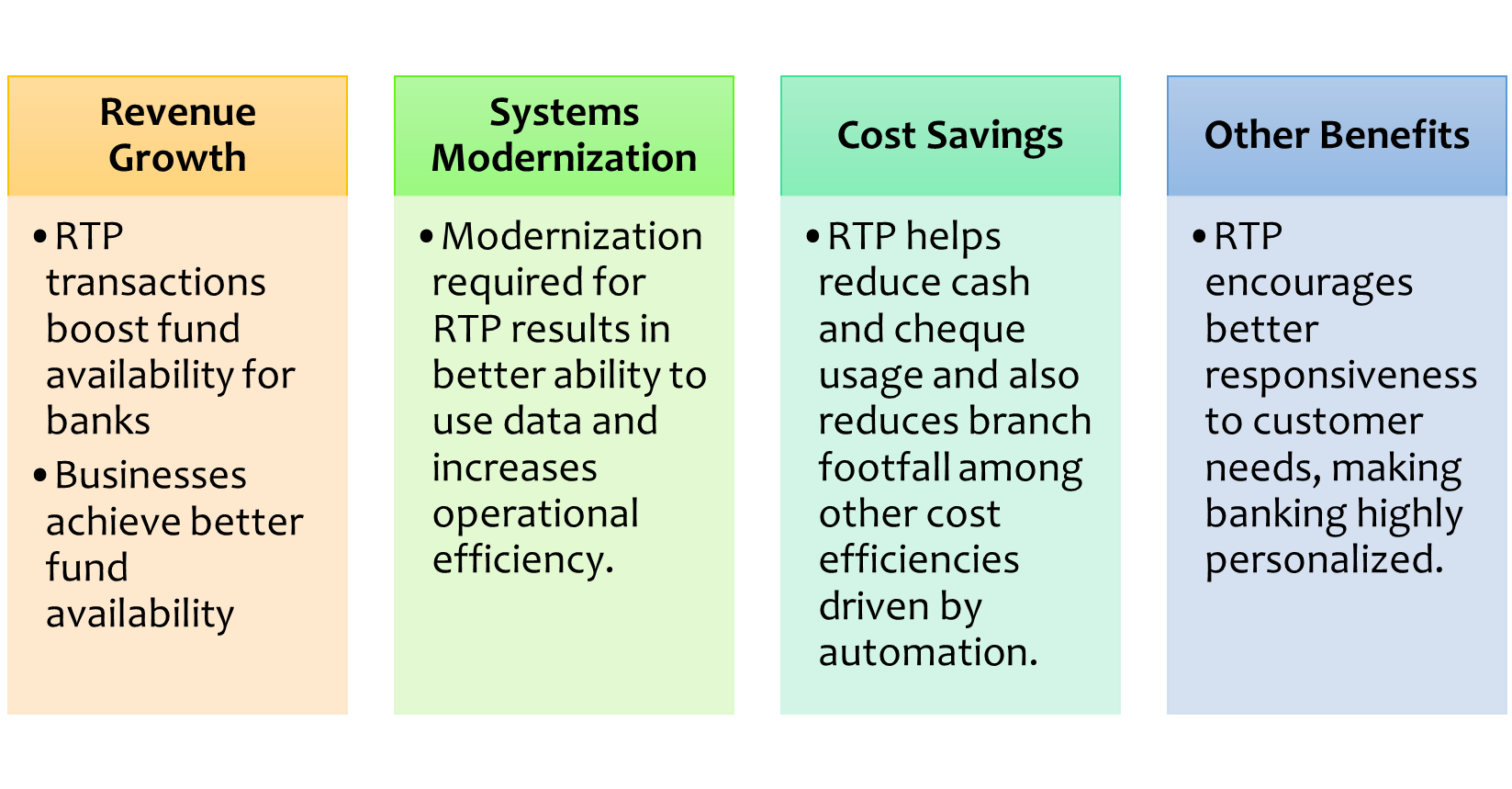

Benefits of Real-time Payments for Banks

According to the Ovum 2018 Global Payments Insight Survey, 85% of banks globally believe that real-time payments are the foundation for growth and new product enhancements.

Our Real-Time Payments Initiatives

Axletree Solutions Inc has been serving the global fintech ecosystem for over two decades, providing leading connectivity and integration solutions to corporates and banks worldwide. Evolvus Technologies Inc Ltd pioneers with payments modernization solutions for corporates and banks automating ACH and Real-Time Payments solutions covering more than 45 banks across the globe. Axletree Solutions and Evolvus Technologies have partnered to drive payments innovation in the USA market.

The partners offer best in class RTP solutions whereby businesses can pay and receive payments instantly, improvise their business processes to benefit from instant payments, and achieve improved cashflow and better visibility to fund positions.

Conclusion

The adoption of Real-time Payments will significantly transform the payments ecosystem and drive business innovation in the USA. Consumer and business payment preferences are steadily shifting from cheques to account-based payments, and Real-time Payments will prove to be a key driver in this change.

Explore the futuristic real-time payments solutions for banks and corporates offered by Axletree Solutions and Evolvus Technologies, and be a part of a burgeoning payments revolution.

November 22, 2020